Easy Business Credit Card to Get With a 650 Fico Score

Credit scores (as well known equally FICO scores) of 650, 660, 670, 680, and 690 fall in the range of boilerplate to above average. On the higher terminate of this range, a FICO score of 675 or in a higher place tin can be considered "proficient."

The all-time credit cards and lowest involvement rates are typically reserved for those with excellent credit scores, which begin at almost 725. That said, you lot can all the same become a good bargain on a credit bill of fare with a credit score in the high 600s.

Overview of the Best Credit Cards for 650-699 Credit Score

| Credit carte du jour | Best for |

|---|---|

| Capital letter One QuicksilverOne Cash Rewards Credit Bill of fare | Greenbacks rewards |

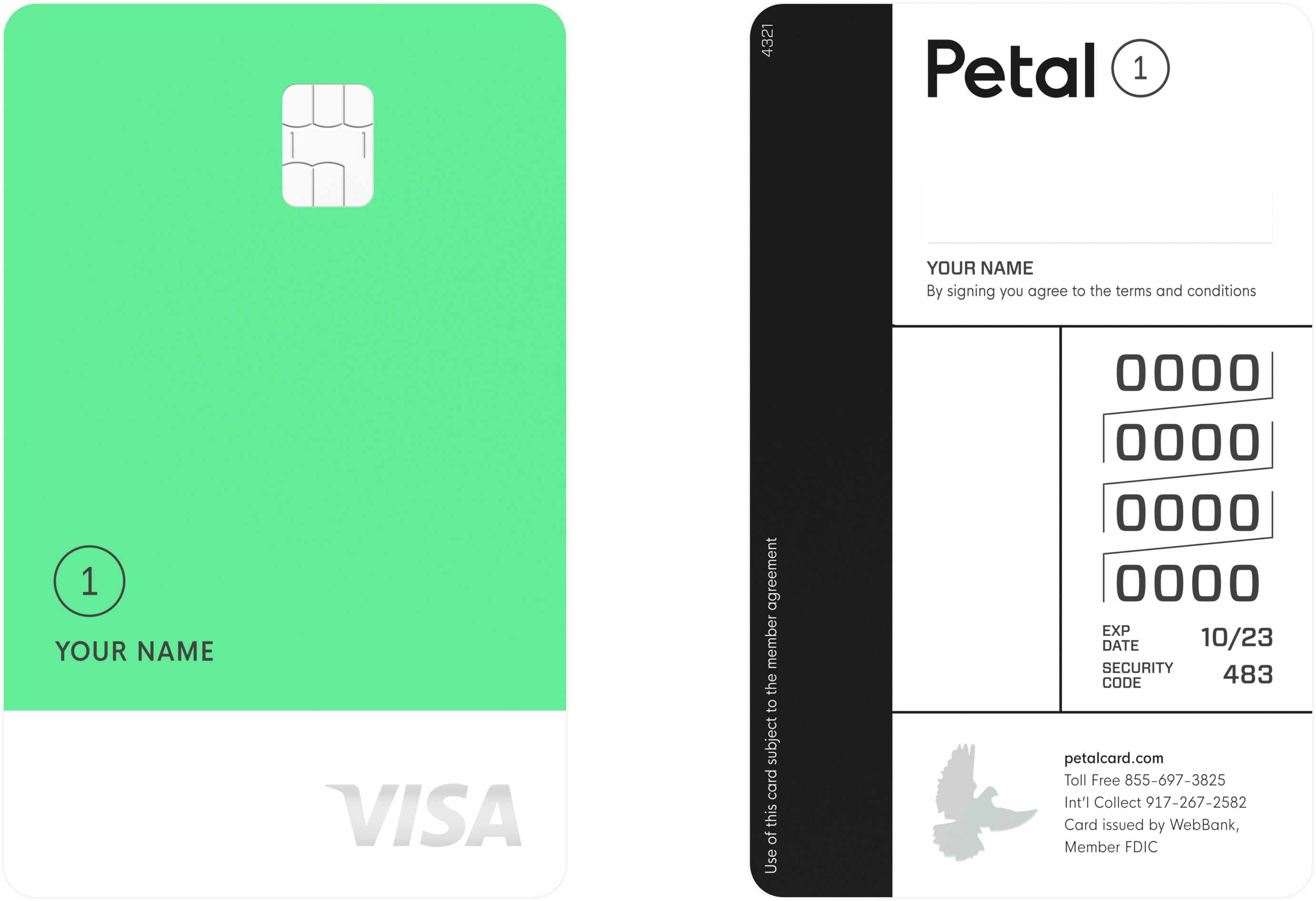

| Petal® 1 "No Annual Fee" Visa® Credit Carte du jour | Building credit while earning rewards |

| Petal® 2 "Cash Back, No Fees" Visa® Credit Carte | Higher credit limits |

| Capital One Platinum Credit Carte | Building credit |

| Indigo® Platinum Mastercard | Recent defalcation |

In A Nutshell

If you don't have the excellent credit needed to score some of the bonuses other Capital One credit cards offer, consider the Capital One QuicksilverOne Greenbacks Rewards Credit Card. Information technology's a terrific card for average credit and you can still earn 1.5% cash back on all purchases with a pocket-sized $39 annual fee.

Read review

Poor 500-599

Off-white 600-699

Good 700-749

First-class 750-850

What We Like:

-

1.5% greenbacks dorsum on all purchases.

-

Be automatically considered for a higher credit line in as little equally six months.

-

No foreign transaction fees and a modest $39 annual fee.

- Earn unlimited 1.v% cash back on every buy, every day

- No rotating categories or limits to how much you lot can earn, and cash back doesn't expire for the life of the account. It's that unproblematic

- Be automatically considered for a college credit line in as little as half dozen months

- Enjoy peace of heed with $0 Fraud Liability and so that you won't be responsible for unauthorized charges

- Aid strengthen your credit for the futurity with responsible card use

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where yous'll get Capital One's best prices on thousands of trip options. Terms apply

- Monitor your credit score with CreditWise from Majuscule One. Information technology'due south gratuitous for everyone

- Cheque out quickly and securely with a contactless card, without touching a terminal or handing your card to a cashier. Just hover your card over a contactless reader, wait for the confirmation, and you're all set

Regular APR

26.99% (Variable)

Intro APR

Intro April Purchases Northward/A , North/A

Intro APR Residue Transfers N/A , N/A

Utilize Now >>

In A Nutshell

The Petal® ane "No Annual Fee" Visa® Credit Carte du jour is a great no-annual-fee card with a solid rewards system for people with limited or no credit. It reports to all 3 major credit card bureaus and y'all can score a higher credit limit between $300- $5,000 — only brand sure to use your bill of fare responsibly. The Petal® 1 "No Annual Fee" Visa® Credit Card is issued by WebBank, Member FDIC.

Read review

Poor 500-599

Off-white 600-699

Skilful 700-749

Excellent 750-850

What Nosotros Like:

-

No credit history required, making it perfect for beginners.

-

No annual fee, and no over-limit or foreign transaction fees, either.

-

2% – 10% cash back at select merchants.

- $0 Almanac Fee

- Variable APRs range from 21.49% - thirty.99%

- $300 - $5,000 credit limits

- Earn a credit limit increase in as little as six months. Terms and conditions utilise.

- No credit score? No problem. If eligible, nosotros'll create your Cash Score instead.

- ii% - 10% greenbacks back at select merchants

- Run into if y'all're pre-canonical within minutes without impacting your credit score.

- No almanac or foreign transaction fees.

- Build credit alongside hundreds of thousands of Petal card members.

- Petal'south mobile app makes it like shooting fish in a barrel to manage your money, runway your spending, and automate payments.

- Petal reports to all iii major credit bureaus

- No deposits required

- Menu issued by WebBank, Member FDIC

Regular APR

21.49% - 30.99% Variable

Intro April

Intro APR Purchases N/A ,

Intro April Balance Transfers Due north/A ,

Apply Now >>

In A Nutshell

The Petal® ii "Greenbacks Back, No Fees" Visa® Credit Bill of fare is a great no-fee card with a solid rewards organization for people with limited or no credit. It reports to all three major credit card bureaus and yous tin score a credit limit betwixt $300 – $10,000 — just make sure to apply your bill of fare responsibly. The Petal® 2 "Cash Back, No Fees" Visa® Credit Card is issued by WebBank, Member FDIC.

Read review

Poor 500-599

Fair 600-699

Good 700-749

Excellent 750-850

What Nosotros Like:

-

1-ane.5% greenbacks back with additional greenbacks dorsum opportunities.

-

The card doesn't accuse an annual fee, and there are no over-limit or foreign transaction fees, either.

-

A credit limit between $300 – $ten,000 and the opportunity to build your credit.

- No fees whatsoever. No late fee, strange transaction fee, annual fee, or whatever-other-kind-of-fee, fee.

- Variable APRs range from fourteen.49%-28.49%

- Upwards to one.5% cash back on eligible purchases after making 12 on-time monthly payments.

- i% greenbacks back on eligible purchases right away

- 2% - ten% cash dorsum at select merchants

- $300 - $10,000 credit limits

- No credit score? No problem. If eligible, we'll create your Cash Score instead.

- Encounter if you lot're pre-approved inside minutes without impacting your credit score.

- Build credit alongside hundreds of thousands of Petal menu members.

- Petal reports to all three major credit bureaus.

- No deposits required

- Bill of fare issued by WebBank, Member FDIC

Regular APR

14.49%-28.49% Variable

Intro Apr

Intro April Purchases N/A ,

Intro APR Balance Transfers N/A ,

Utilise Now >>

In A Nutshell

Finding an unsecured credit card with average credit tin exist difficult, but the Upper-case letter Ane Platinum Credit Card is happy to take your business organization. Yous won't discover many perks to owning this credit card, just it'due south a bang-up beginning card for young people looking to build a stiff credit history and there'southward no almanac fee.

Read review

Poor 500-599

Fair 600-699

Skilful 700-749

Fantabulous 750-850

What We Like:

-

But average / fair / express credit is required for approval

-

Be automatically considered for a higher credit line in as piddling as half dozen months

-

No almanac fee or foreign transaction fees

- No almanac or hidden fees. Come across if you're approved in seconds

- Exist automatically considered for a higher credit line in every bit trivial as 6 months

- Assistance build your credit through responsible use of a carte like this

- Relish peace of mind with $0 Fraud Liability so that you won't exist responsible for unauthorized charges

- Monitor your credit score with CreditWise from Uppercase One. It'south free for everyone

- Become access to your account 24 hours a solar day, 7 days a week with online banking from your desktop or smartphone, with Capital letter I'south mobile app

- Cheque out chop-chop and securely with a contactless card, without touching a last or handing your card to a cashier. Simply hover your carte over a contactless reader, wait for the confirmation, and you're all set

- Pay by bank check, online or at a local branch, all with no fee - and pick the monthly due date that works all-time for yous

Regular APR

26.99% (Variable)

Intro APR

Intro April Purchases N/A , N/A

Intro APR Balance Transfers N/A , Due north/A

Apply Now >>

In A Nutshell

The Indigo® Platinum Mastercard® offers consumers with poor credit the opportunity to use a credit carte du jour for everyday spending. Pre-qualification is quick and easy and if you accept the credit profile needed, you might be able to secure a credit card with no almanac fee. ($0 – $99 almanac fee).

Read review

Poor 500-599

Fair 600-699

Good 700-749

Splendid 750-850

What We Similar:

-

$0 – $99 annual fee

-

Easy pre-qualification process

-

Previous bankruptcy is OK

- Like shooting fish in a barrel pre-qualification process with fast response

- Less than perfect credit is okay

- Online servicing available 24/7 at no additional price

- Unsecured credit card, no security eolith required

- Account history is reported to the three major credit bureaus in the U.S.

Intro Apr

Intro APR Purchases N/A , N/A

Intro APR Balance Transfers N/A ,

Utilize Now >>

In-Depth Assay of the All-time Credit Cards for 650-699 Credit Score

Capital One QuicksilverOne Cash Rewards Credit Card — Best for cash rewards

Card features:

- Annual fee: $39

- Apr:26.99% (Variable)

- Rewards: one.5% cash back on all purchases

- Other features: $0 fraud liability, gratis credit score monitoring, and auto rental standoff damage waiver

Why the Capital One QuicksilverOne Greenbacks Rewards Credit Carte du jour is a expert pick for those with average credit

The Capital One QuicksilverOne Cash Rewards Credit Card has a very attractive cash rewards offer for consumers with average credit. You can earn i.5% greenbacks back on all purchases, and there are no rotating spending categories requiring yous to adjust your activity every quarter. The carte du jour as well comes with $0 fraud liability, free credit score monitoring, and auto rental collision damage waiver. If you outset with a depression credit limit, you will be eligible for automatic increases after making only half dozen on time monthly payments.

How to utilize the Capital One QuicksilverOne Greenbacks Rewards Credit Menu

Brand your payments on time every month, and Upper-case letter One volition begin reviewing your credit limit after just six months. This will non only provide you with a good credit reference, just the potential for a higher credit limit may improve your credit utilization ratio.

Why you might not want to consider the Capital letter One QuicksilverOne Greenbacks Rewards Credit Card

The major drawback of greenbacks dorsum credit cards — ironically — is that they can cause you lot to spend more money than you otherwise would. That can lead to not only excess spending, but also an unmanageable credit balance. Run into bill of fare details/apply or read our full Capital 1 QuicksilverOne Cash Rewards Credit Menu review.

Petal® 1 "No Annual Fee" Visa® Credit Card — Best for Building Credit while Still Earning Rewards

Bill of fare features:

- Annual fee: $0.

- APR: 21.49% - 30.99% Variable.

- Rewards: 2%-10% greenbacks back on purchases at select merchants.

- Other features: ideal for individuals with limited or no credit.

Why the Petal® ane "No Annual Fee" Visa® Credit Carte is a good option for those with average credit

Instead of going solely by your credit score, the Petal® ane "No Almanac Fee" Visa® Credit Card bug a "Greenbacks Score," which loops in your income, spending, and savings.

Once y'all've been approved and have your card, the Petal® one "No Annual Fee" Visa® Credit Bill of fare reports your on-time monthly payments to all three credit bureaus, helping you lot better your credit score while you spend.

The Petal® 1 "No Annual Fee" Visa® Credit Card is issued by WebBank, Fellow member FDIC.

How to use the Petal® one "No Annual Fee" Visa® Credit Card

If you're interested in strengthening your credit score, the Petal® i "No Annual Fee" Visa® Credit Bill of fare can help you lot with that. Just brand sure y'all pay your bill on fourth dimension each month and you'll gradually start to come across your score tick upward.

Yous'll also need to check the app on a regular basis to look for cash back offers. Yous tin can earn 2% to x% cash back on your purchases in those select categories.

Why you might non want to consider the Petal® 1 "No Almanac Fee" Visa® Credit Carte

With the Petal® one "No Annual Fee" Visa® Credit Card, you'll exist issued a credit limit betwixt $300 and $v,000. While the upper tier of that limit is pretty proficient, at this fourth dimension, you can't negotiate that limit upward, and it won't automatically be increased afterwards a stock-still period of time, unlike other cards in its class.

As you see your credit score better, you may also desire to shift to a card that earns you lot unlimited cash back on all your purchases, similar the Petal® ii "Cash Back, No Fees" Visa® Credit Card .

See carte du jour details/apply.

Petal® 2 "Greenbacks Dorsum, No Fees" Visa® Credit Menu — Best for Higher Credit Limits

Card features:

- Annual fee: $0.

- Apr: 14.49%-28.49% Variable.

- Rewards: one%-i.5% unlimited cash back on all purchases field of study to on-fourth dimension payments; two%-10% at select merchants.

- Other features: Credit line of up to $10,000, no over-limit or international transaction fees.

Why the Petal® ii "Cash Dorsum, No Fees" Visa® Credit Card is a good option for those with boilerplate credit

The Petal® 2 "Cash Back, No Fees" Visa® Credit Card is great for those who may be new to credit because your credit score is only ane of the factors used to determine whether y'all qualify. Petal® 2 "Greenbacks Back, No Fees" Visa® Credit Card also uses your income, spending, and savings to gauge your creditworthiness. Plus, you won't have to put down a deposit to secure your credit line.

Best of all, the Petal® two "Cash Dorsum, No Fees" Visa® Credit Bill of fare reports your payments to all three credit bureaus, making it a great way to earn rewards while besides improving your credit score.

Yous'll get a credit limit of $300 – $x,000 with the card. The upper limit is pretty impressive, especially for those with less than perfect credit.

How to use the Petal® 2 "Cash Back, No Fees" Visa® Credit Card

In one case you're approved, pull upward your business relationship in Petal's easy to use app and pay close attention to the electric current rewards being offered. Yous can earn between 2%-10% cash back by spending at certain merchants. Only you'll likewise earn ane%-i.5% cash back on every purchase, regardless of category. To become the higher ane.5% cash dorsum, all you demand to do is make 12 on-time monthly payments.

Plus, if you pay your rest by the due appointment every calendar month, you lot'll exist able to start improving your credit score.

Why you lot might not desire to consider the Petal® 2 "Cash Back, No Fees" Visa® Credit Bill of fare

As with many credit cards that cater to those with average credit, you'll pay a footling more in interest (14.49%-28.49% Variable) than cards with stricter credit requirements. And then, if yous need to conduct a balance, yous'll be racking upwards a lot in interest charges.

See carte du jour details/utilise.

Capital Ane Platinum Credit Card — Best Credit Carte for Edifice Credit

Carte features:

- Annual fee: $0

- April range:26.99% (Variable)

- Rewards: None

- Other features: $0 fraud liability, and auto rental collision damage waiver benefits

Why the Uppercase One Platinum Credit Bill of fare is a good choice for those with average credit

The Capital One Platinum Credit Menu is a no-frills credit card for those on the lower terminate of the average credit score range, who are mostly interested in either rebuilding or improving their credit score. The card doesn't offering cash back rewards or points. But it does offer $0 fraud liability, and auto rental collision harm waiver benefits. In add-on, in that location is no almanac fee for this bill of fare.

How to utilize the Capital One Platinum Credit Card

This is really a bill of fare designed for those with fair credit, merely in the credit card universe, even a credit score in the mid-600s could be considered fair. If yous've been unable to go a credit card elsewhere, this one is an excellent choice. Every bit long as you pay off your balance monthly, it will be a cost-effective way to improve your credit score, particularly since there's no annual fee.

Why you might non want to consider the Uppercase One Platinum Credit Card

The only reason you might avert this carte du jour is because you qualify for a card that too includes cash dorsum rewards or points. Otherwise it's an excellent menu to rebuild or better your credit score. Encounter menu details/apply or read our full Uppercase 1 Platinum Credit Card review.

Indigo® Platinum Mastercard— Best Credit Card for Recent Bankruptcy

Carte features:

- Annual fee:$0 - $99

- April range:24.9%

- Rewards: None

- Other features: Master RoadAssist services, Travel assistance services, Principal rental insurance, Extended warranty coverage, and Price protection

Why the Indigo® Platinum Mastercard is a good option for those with average credit

The Indigo® Platinum is great for those with average credit, and even no credit at all! You won't have to brand a down payment, even if you accept poor credit, and Indigo reports to all three credit bureaus, so you tin first building your credit every bit soon as you get your bill of fare.

Finally, those with a recent bankruptcy can as well qualify for the Indigo® Platinum Mastercard.

How to use the Indigo® Platinum Mastercard

The application process for the Indigo® Platinum is quick and easy. The online application is just a few questions. If you lot have your personal and bank info on hand, y'all tin authorize in simply a few minutes.

As e'er, pay off the balance of your menu in full each calendar month, and you lot can apace build credit.

Why you might non want to consider the Indigo® Platinum Mastercard

We don't like information technology when low-credit credit cards have an annual fee, and this carte du jour unfortunately does, and it's a loftier one, at upwards to $99.

See card details/apply.

Summary of the Best Credit Cards if your FICO Score is 650 to 699

In the table below, we summarized the chief information for each of the cards we presented equally the best cards if your FICO score is between 650 and 699:

| Card/category | Almanac fee | April range | Credit line increases? | Sign-on bonus offer | Rewards |

|---|---|---|---|---|---|

| Capital Ane QuicksilverOne Cash Rewards Credit Carte | $39 | 26.99% (Variable) | Yes, reviewed subsequently six months | N/A | one.5% unlimited cash dorsum all purchases |

| Petal® ane "No Almanac Fee" Visa® Credit Card | $0 | 21.49% - 30.99% Variable | Not available at this fourth dimension | North/A | 2%-x% cash back from select merchants |

| Petal® 2 "Cash Dorsum, No Fees" Visa® Credit Card | $0 | fourteen.49%-28.49% Variable | Non available at this time | North/A | 1%-1.5% unlimited cash back on all purchases; 2%-10% from select merchants |

| Upper-case letter I Platinum Credit Card | $0 | 26.99% (Variable) | Yep, reviewed after half-dozen months | N/A | North/A |

| Indigo® Platinum Mastercard® | $0 - $99 | 24.9% | N/A | Due north/A | Northward/A |

How We Came Up with this Listing

In the list we nowadays in this guide, we focused on cards requiring average credit scores. Other important card features we considered include:

- Upfront and ongoing rewards/cash dorsum.

- Low or no almanac fee.

- Competitive interest rate range.

- Offering the power to increase your credit line as your payment history warrants.

- Other carte benefits.

What is Boilerplate Credit?

Average credit actually floats somewhere in the unspecified zone between the upper reaches of "fair" and the lower end of "skilful" credit. In other words, betwixt 650 and 699.

When information technology comes to credit cards, average credit is very subjective. One credit card visitor might consider it 675 to 724, while another may decide information technology's 640 to 679. But it's condom to say if y'all fall somewhere between 650 and 699, you'll exist considered to have average credit with most banks.

Read more: What is a Skillful Credit Score?

What factors bear upon your credit score?

Your credit score is comprised of v factors: payment history, amounts owed, length of credit history, new credit, and credit mix. When yous're in the average credit score range, your credit score tin be afflicted by whatever of these five factors. In fact, your payment history may not even be a major issue. Even though your payment history is flawless, your credit score can still fall below 700 if you owe too much on your credit cards, or if you have too much new credit.

How to Find the Best Credit Cards if Your FICO score is 650 to 699

When yous reach a FICO score between 650 and 699 your credit card options start to open up up considerably.

1 type of menu that is less relevant after y'all attain this credit score range is a secured credit card. These cards are more than suitable if your credit score is beneath 650, and especially when it's below 600.

Just in the average credit score range, you should be able to qualify for unsecured cards with very piffling effort. What you lot won't detect available to you (withal) are unsecured cards with the best terms on the market place. For case, you lot won't qualify for the everyman interest rates, nor volition y'all be eligible for the cards with the most generous rewards programs. Simply you tin can still become a carte with an acceptable credit limit, and at least some greenbacks back rewards. And if you lot pay your balance off monthly — as nosotros will recommend throughout this guide — the high involvement charge per unit won't matter so much.

Read more than: How to Use a Credit Menu Responsibly

The Most Important Features of Credit Cards if Your FICO Score is Betwixt 650 and 699

Shopping for credit cards in the average credit score range is a lot more fun than it is if your score is beneath boilerplate. This is the range when you lot start to look more selectively for the perks that a card offers, rather than just settling for whatever card yous tin qualify for. Hither are the factors we consider most of import in this credit score range:

Annual Pct Rate (April)

In this credit score range, you start to see lower interest rates on credit cards. A card may offering 14.99% to 24.99%.

That said, the best way to avoid interest charges is to ensure that you make a in full before your bill is due.

Annual fee

There are more credit cards available in this credit score range that have either low or no annual fee. Naturally, you want to avoid an almanac fee if you can. Only if you lot're at the lower finish of the credit score range, it may exist worth information technology to take a carte du jour with the fee, and use the credit line to amend your score. Later you practise, yous'll be eligible to use for credit cards with no almanac fee.

Read more: Best No Almanac Fee Credit Cards

Introductory Offer

Lucrative welcome offers may starting time to pop up occasionally amidst credit cards for this credit score range. Yous may see them show upward equally bonus points or greenbacks rewards for spending 10 corporeality inside the first three months.

Another popular introductory offering — though non as common in this credit score range — is the 0% introductory offering. A credit card may offer this for the first 12 months or longer after your credit line is canonical. It may exist available for both remainder transfers and purchases.

Read more: Best 0% Apr Credit Cards

Credit Carte du jour Rewards

These are the ongoing rewards, like 1-i.5% cash dorsum on standard purchases. Some credit cards may also offer y'all enhanced greenbacks back rewards or points on certain spending categories. These categories usually change on a quarterly basis and can utilize to gas, groceries, eating house meals, or other spending categories.

Read more: Best Cash Dorsum Credit Cards

Secured Vs. Unsecured Cards

Credit cards can exist either secured or unsecured, though unsecured is by far the most common type. If your FICO score is 650 to 699, yous will most probable go unsecured cards. But a brief discussion of secured cards is worthwhile, since it may apply to a few consumers in this credit score range who are unable to get unsecured cards.

Secured cards

Secured cards are just what the proper noun implies. The corporeality of your credit line is typically based on the security deposit you put upward. For example, if yous make a $300 deposit, yous'll unremarkably take a corresponding $300 credit limit.

Other than the security deposit, secured cards work just like unsecured cards. You run charges and brand monthly payments. The payment history is reported to the major credit bureaus, which will impact your credit score. And even though there is a security deposit, y'all will still exist charged interest on outstanding balances.

Secured cards often come with no almanac fee or a very depression one. Most will eventually increase your credit limit based on your on-time monthly payments. And some will convert your carte du jour to unsecured after a certain amount of fourth dimension.

Read more: Best Secured Credit Cards

Unsecured cards

Naturally, no security deposit is required for unsecured cards. Just the almanac fee may be college than information technology is for a secured carte du jour. The table below summarizes the difference between secured and unsecured credit cards:

| Secured cards | Unsecured cards | |

|---|---|---|

| Make purchases on credit | Yes | Yes |

| Report to all iii credit bureaus | Yes | Aye |

| Annual fee | Usually very low (≤$35) | Tin be every bit high as $500+ |

| Involvement rate | Usually 18%-30% | Usually xv%-25% |

| Automatic credit line increases | Yes | On some only |

| Convert to unsecured | Generally, yes | Northward/A |

Note: All cards on this page selected for credit scores between 650 and 699 are unsecured.

How to Properly Utilise a Credit Card for Average Credit

When you're in the boilerplate credit score range, one of your chief goals with any credit carte should be to help you move into the skillful/fantabulous range. That will only happen with proper use of your credit card. Good practices include:

Pay Off your Residue Quickly and Regularly

In the boilerplate credit score range, it's still very likely you lot'll pay the maximum interest rate. If that interest rate is high, for instance 24.99%, this will have obvious implications if you conduct a balance. The interest rate will make having the menu more expensive unless you diligently pay off the card balance in full each calendar month.

Charge No More than than you lot Tin Easily Repay when the Bill Comes in

In society to be able to pay your balance in total each calendar month, you lot should avoid charging more than you'll be able to repay the next month. A credit menu is not a blank check. No matter what the credit limit is, you need to set your own budget for that bill of fare. If the credit limit is $2,000, only you can afford to repay only $400 the following calendar month, then $400 needs to be your credit limit.

Rewards can Lower the Cost of your Credit Card

One of the advantages of being in the 650 to 699 credit score range is that some cards offer rewards. If a menu pays i.v% cash back, and you charge an boilerplate of $500 per month, y'all'll earn $vii.50 per month or $ninety per yr. If y'all don't bear a residual — and don't pay involvement — it'll be similar earning an extra $ninety per year. What you earn in rewards/cash dorsum will hopefully be enough to cover the almanac fee, making the card essentially free to use.

Tips to Amend Your Credit

Improving your credit score is an of import financial goal when you're in the average credit score range. Moving your credit score to in a higher place 700 can bring you a lot of bonny credit offers. But to do that, yous'll have to successfully manage your credit carte usage.

Monitor Your Credit Score from Now on

You lot don't want to become obsessive well-nigh this, but you exercise need to have a general idea where your credit score is at any time. At a minimum, a serious negative change in your credit score can indicate either an error on your report or even fraudulent activity. Only by knowing what your credit score is on a regular basis will you be able to observe and bargain with either situation.

Read more: How to Get a Gratuitous Credit Report and Credit Score

Dispute Any Errors

One of the major purposes for monitoring your credit is to correct errors. If yous monitor your credit on a monthly footing, you'll detect those errors shortly subsequently they happen. That's important because yous'll take both better recollection of what really happened, as well equally documentation. Yous'll need both to correct the error.

If you do detect an error, contact the creditor immediately and dispute it. You lot'll have to provide written documentation of your instance. If the creditor agrees that the entry is an error, have them ostend that in writing. Also, request they study the corrected information to all three credit bureaus. Wait 30 days, then cheque your credit once again.

If the information continues to appear on your credit report, mail a copy of the letter from the creditor to each of the credit bureaus, and request they correct the data.

Pay ALL Your Bills on Time

This should be completely obvious, merely information technology bears repeating. A single late payment could drop your credit score 20 or 30 points. That tin can drop you from average to fair credit in a affair of weeks. Information technology's not just about repaying your creditors on time either. If yous get backside with a utility company or a landlord, they may report the unpaid balance to the credit bureaus. That volition also driblet your credit score.

This is why it's disquisitional to pay all bills on time, all the time.

Pay Off Whatsoever By Due Balances

If your credit report reflects any unpaid balances, pay them off. If you believe the balance to exist an fault, you'll have to dispute it and provide written documentation of your merits. If y'all can't, it's best to pay it and be on your style. A paid collection or accuse-off is always improve for your credit score than an unpaid 1.

Read more: Can I Set Sometime Unpaid or Charged Off Accounts on My Credit Written report?

Go Slow Applying for New Credit

Fifty-fifty in one case you get a credit menu approved, y'all should allow plenty of time pass before applying for another. At to the lowest degree vi months is recommended.

Alternative Cards for People with Credit Scores Betwixt 650 and 699

Alternative cards are less of an outcome in the average credit score range than they are with fair or poor credit scores. Only there may withal be circumstances where you will desire to have ane or more than of those alternative cards.

Debit Card

A debit card is basically a necessity these days considering it gives y'all straight admission to your banking company account. Information technology's also an excellent way to manage your finances. You can't spend any more than you take in your account, which puts a natural limit on spending. And if zero else, having a debit card will reduce your dependence on your credit card. That volition help to avoid running up your credit carte du jour balance.

A debit carte doesn't assist you build credit

As valuable equally debit cards are, their use is not reported to the credit bureaus. These are strictly fiscal management tools and non credit architect cards.

A debit carte du jour can help you manage your finances

This is probably the most important benefit of having a debit carte du jour. If y'all maintain your upkeep primarily through your checking business relationship, the business relationship balance will serve as a natural limit on your debit menu spending.

Read more: How to Use Your Debit Card Safely

Prepaid Cards

From a standpoint of having a credit card-similar card, prepaid cards are commonly not necessary if your credit score is at least 650. Only they do accept a purpose and may be worth considering.

How Do Prepaid Cards Work?

Prepaid cards are available everywhere these days. You buy a card by adding a certain amount of coin to it. The amount of money yous add is your spending limit. You'll pay a small fee for the purchase of the card. You tin can and so apply the prepaid carte du jour the same way you would a credit or debit card.

Yous can add money to a prepaid card on an ongoing ground by recharging it, which will typically require the payment of a minor fee each time.

The Benefits and Limitations of Prepaid Cards

The two biggest limitations of prepaid cards are:

- They do nothing to improve your credit score

- They accept to constantly be recharged

But they have one do good that'southward not bachelor with either credit cards or debit cards. When you use a prepaid card, it leaves no record of account data. That almost eliminates the possibility of identity theft. They're well-suited to making purchases online, or even in person with vendors you don't entirely trust. You lot can brand your purchase, and not take to worry about leaving a paper trail behind.

Only the absence of a paper trail points to another disadvantage. Prepaid cards lack the type of buyer protection benefits available with debit cards and especially with credit cards.

Read more: Is There Ever a Skilful Reason to apply a Prepaid Card?

Shop Charge Cards

If your FICO score is 650 to 699 y'all shouldn't accept too much trouble getting general credit cards. But if the credit limit on your carte is on the low side, you may desire to supplement information technology with a store card.

How shop cards work

Store cards are issued by private merchants. You may have a credit bill of fare issued past Sears, JCPenney, Macy'southward, or other retailers, but they're non credit cards in the usual sense. They can merely be used to charge purchases through that merchant. You volition not exist able to use the menu to make other purchases, like groceries and gas.

Are store cards a proficient idea?

Store cards can brand sense if y'all do a lot of business with the card's issuing merchant. Just they're field of study to all the limits of general credit cards. For example, you should avoid carrying a residue, as interest rates on store cards can exist excessive.

Read more: The All-time Shop Credit Cards

The Advantages and Disadvantages of Debit, Prepaid, and Store Cards

| Debit cards | Prepaid cards | Store cards | |

|---|---|---|---|

| Require credit blessing? | Limited | No | Yeah |

| Report to credit bureaus? | No | No | Aye |

| Will ameliorate your credit score? | No | No | Possibly |

| Purchases subject field to involvement charges? | No | No | Yep |

FAQs

Pay on time, every time. You're probably enlightened that missing a credit carte du jour payment is bad for your credit, but so is a late payment. Brand sure you pay your credit card bill on fourth dimension every month. Keep your utilization ratio low. Experts propose that you continue your credit utilization ratio below thirty% to maintain a healthy credit score and below ten% if you want an excellent credit score. Pay often. Making frequent payments is an effective fashion to continue your residual low. Dispute any issues. It'southward of import that yous bank check your credit score regularly so you can identify whatever bug. If an outcome does arise brand certain that y'all dispute it immediately. Don't go overboard on inquiries. If yous want to hit the 800, don't utilize for multiple credit cards or loans at the same fourth dimension. Multiple difficult inquiries in a curt period of time can hurt your credit. Be patient. If you've e'er missed a payment or take another blip on your credit score, it volition be in that location for seven years. Achieving a credit score of 800 will be difficult until this expires off of your credit history.

It'south ordinarily better to leave a credit card with a cipher balance open up because closing information technology will reduce your credit utilization ratio. By closing the credit menu, you will reduce the total available corporeality of credit you have which can and then increase your utilization ratio.

Applying for more than one credit card in a short amount of time tin can hurt your credit score. When y'all utilize for multiple cards, it can signal to lenders that you are a riskier borrower. To be strategic it'southward a good thought to space out your applications by six months to permit fourth dimension for your credit score to come back up afterward the inquiry.

Showtime with your highest interest debts. Credit cards typically take some of the highest interest, so carrying these balances can be detrimental to your credit score. When it comes to which credit cards you lot should pay off commencement, get-go with your lowest balance credit card (regardless of involvement rate) and pay it off. Once your lowest debt card is paid, move on to the carte with the next lowest balance. This method of debt repayment can help to improve your credit carte du jour score rapidly. Each time you lot pay off a credit card in full, y'all volition reduce your credit utilization ratio for that card and, you will reduce the total number of accounts yous accept with outstanding balances. Don't forget to pay the minimum balance on all of your credit cards throughout your debt repayment journey.

It is ameliorate to pay your credit card off in full rather than carrying a balance. This is true for a few reasons. When you bear a credit card balance you will have to brand interest payments. These payments tin add together upward over time. When y'all pay your credit card in full this can help to reduce your credit utilization ratio for that credit carte. Paying in full too reduces the full number of accounts that are open with outstanding balances. Both of these things can assist to amend your credit score.

Related Tools

Relieve Your Starting time - Or Adjacent - $100,000

Sign Up for free weekly money tips to help you earn and salvage more

Nosotros commit to never sharing or selling your personal information.

Source: https://www.moneyunder30.com/credit-cards/credit-score-650-699

0 Response to "Easy Business Credit Card to Get With a 650 Fico Score"

Postar um comentário